A Platform Design Example Explained

Reshaping Value Chains, applying the Six Platform Plays to explore and design a Platform in the renewable energy context.

Boundaryless Team

The approach we followed in our first Platform Design Bootcamp, a new training program aimed at transferring platform design mastery to expert facilitators, had the objective to both explain in details the way we design workshops and transfer the pillars and theoretical background of our methodology to the attendees, letting them understand profoundly both how to explore opportunities and how to approach the strategic design flow, when working on real project cases.

Trainees worked on pre-compiled examples, differently from what typically happens at the masterclass when on can bring her own project. This helped release the pressure on people of producing a rock-solid design, that was not relevant in this context and freed up space for deep conversations. The 3-day experience was designed to give the attendees as many elements as we could, in order to let them evaluate and manage successfully a variety of requests they could get from organizations, in their professional life.

In the process, we developed several simple examples, clear enough for the didactic purpose. Furthermore, at the Bootcamp, we introduced a streamlined method to explore ecosystems and find opportunities for platformization.

This new approach can also be seen as a consolidated version of the extensive Platform Opportunity Exploration methodology we described in our v0.1 guide published in late 2018. After one year of validation on the field with many organizations, we are ready for the 1.0 version.

Reshaping Value Chains with Platform Strategies with recurring Platform Plays

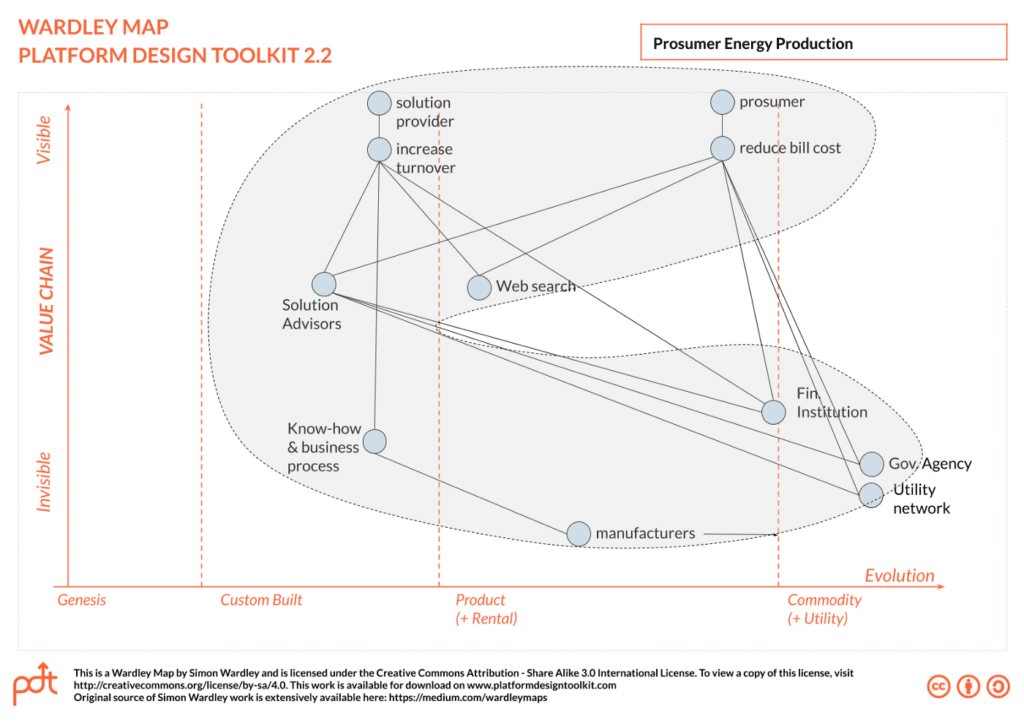

The opportunity exploration flow remains the same you’re used to, from the scanning of the ecosystem through the Ecosystem Scan canvas to the mapping on Wardley Maps. If you’re mapping an industrial/pipelined context or experience, you will probably get a C-shaped value chain on the map, as we have explained in our post here.

A “typical” industrial value chain map — it’s C-shaped

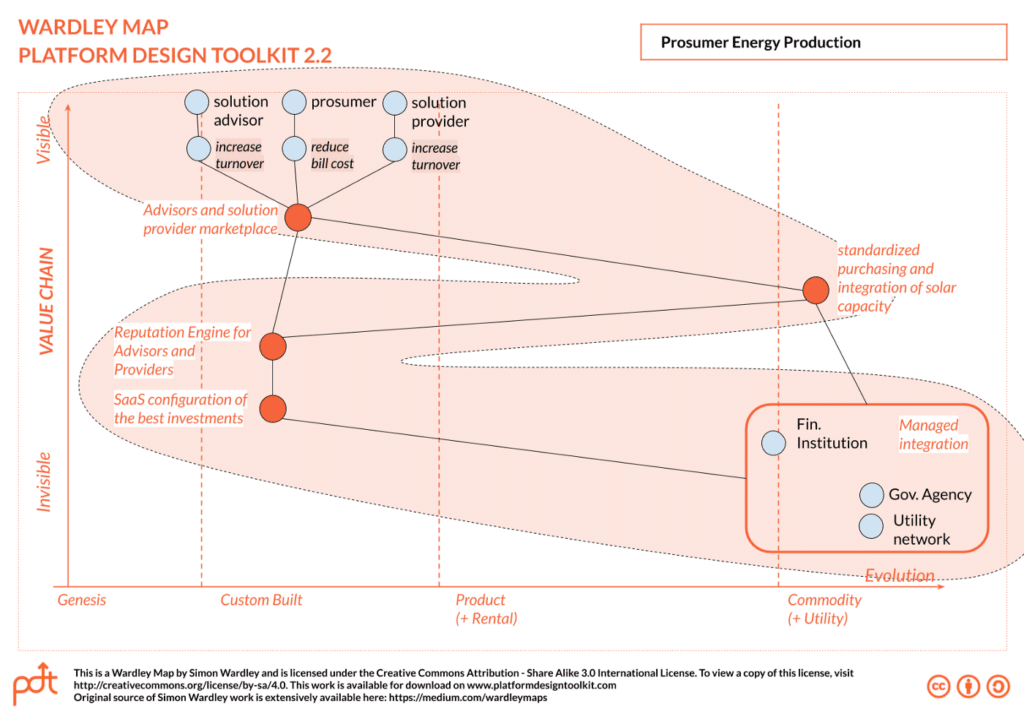

After we are done with the mapping of what is already happening in the ecosystem, we are ready to think about strategies to re-shape this value chain towards a platform playfield. We’ll need to imagine how to transform entities, roles, and components in a new position in the map and start thinking about how an aggregator can organize the interactions and sustain the value streams among producers and consumers. This evolutionary perspective of the ecosystem has typically a Z shape when mapped on a Value Chain map:

A “typical” aggregated (platformized) value chain map — it’s Z-shaped

In the Platform Opportunity Exploration guide v0.1, we described in chapter “From C-shape to Z-shape” how to move from an industrial value chain to a Z-shaped platform strategy by applying the 12 patterns of platformization.

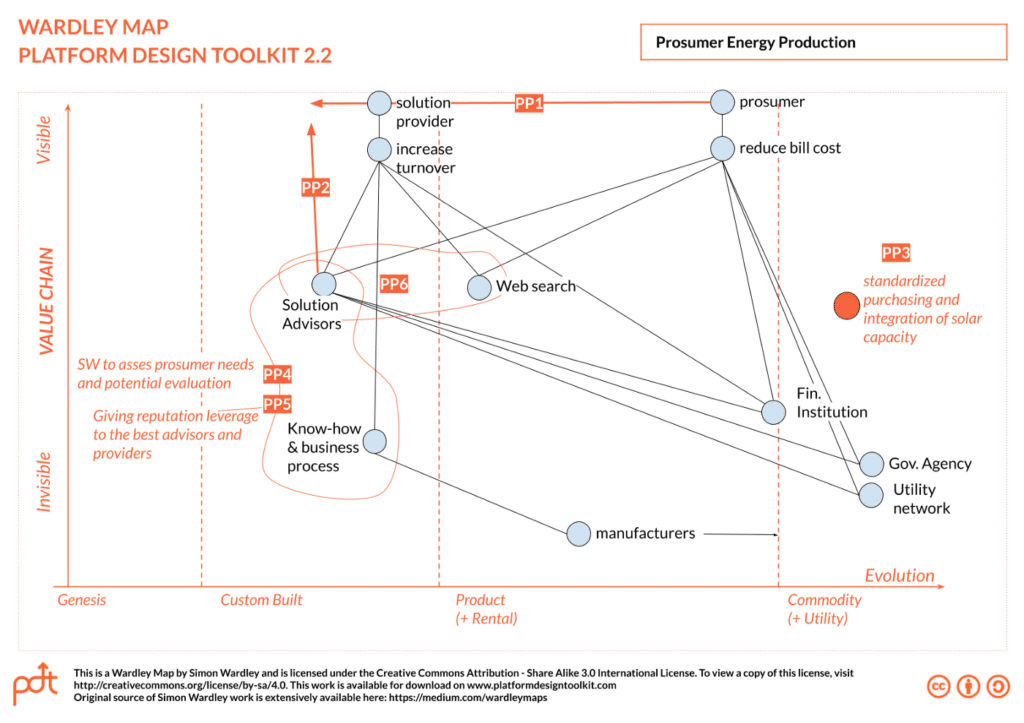

We have streamlined and fluidified the re-shaping workflow, by introducing six Platform Plays, i.e. six recurring strategic plays that typically characterize a pipeline-to-platform transformation to unleash the unexpressed potential emerging from an ecosystem. These six “movements” look very natural if executed on Wardley Maps in a visual thinking process: this is one of the key reasons why we are using this tool in the ecosystems’ exploration stage of Platform Design.

The six Platform Plays

Let’s go through the six platform plays together:

PP1: Bring back personalization of experience for users

If current users are being served by commoditized experiences, platforms ensure to provide “customized” experiences. This implies either connect them with producers (see PP2) on top of a standardized transaction system (see PP3) or to fully control and automatize a mass-customization process that, in any case, may lack the capability to understand the context.

This Platform Play is the right one to help you answer the questions:

- Are users in this value chain looking for stronger personalization?

- If not, what would it mean to serve them like that?

PP2. Bring producers on top of the Value Chain

If there’s a massive amount of producers in this value chain, gaining more potential to create value (for example by means of a technological advancement), and if they are “independent” but, at the moment, hidden by an industrial player (typically as suppliers) or by a frequent mediator (as contractors), they can be brought on top of the value chain and treated as “users” (with an experience to be improved). By putting them at the same level as the consumers and unleashing their capacity to provide custom-built personalization of solutions, platforms can trigger a powerful mind-shift in the ecosystem.

This Platform Play is the right one to help you answer the questions:

- Are producers in this value chain being masked by the industrial players?

- Are producers in this value chain being mediated by marginally value-adding players?

- Are producers in this value chain gaining capabilities through technology or other forms of access?

- How can we bring producers on top of the value chain?

- How can we “unbundle” producers from incumbent industrial players and make them “independent”?

PP3. Standardization of Transactions

To ensure that producers and consumers can interact at scale, the platform shaper needs to ensure that all the peer to peer transactions (e.g.: requirements sharing, booking, purchasing,…) and all the ancillary activities (e.g.: filtering, discovery, …) are as standardized as possible. This approach has deep roots in one of the most important fingerprints of platforms: reducing transaction costs. By reducing transaction costs, Platforms enable more and more small niches to be sustainable in their value exchanges and having a clear, simple and standard transaction engine is fundamental to optimize the “value transfer function” among entities. “Simple and standard” means a longer tail, and a highly scalable strategy.

This Platform Play helps you answer the questions:

- How would a standardized transaction look like in the context I’m shaping?

- How can we leave enough space for informal adaptation to the participants so that they can work with a standardized transaction?

PP4. Complex Business Process embedded into Software as a Service

Evaluate how complex and formal elements of a pre-existing complex business process can be made more accessible (in terms of cost, distribution, etc…) by being codified into a “software as a service” solution. This principle couples with PP3 when contributing to reducing the costs associated with value transactions and also is a core value platforms care in order to keep the rules crystal clear (and well known in advance) to all the entities and roles willing to leverage their potential through the platform. On top of this, by having a SaaS managing the business process allows users to use it directly, without the necessity for the platform runners to have a backoffice staff to make things work, and this helps the growth and scalability of the platform itself.

This Platform Play helps you answer the questions:

- What elements of this business process can be provided in a software as a service to be made available?

- What niches would access to a SaaS solution enabled in this context?

PP5. Enable leveraging on Identity, Reputation and Trust

We are collapsing these two Platform Plays together in the same picture (see the green circle) since there isn’t a specific dedicated “movement” in the space of value chain maps. The creation of a system that allows participants to have a confirmed identity, and accumulate reputation (and therefore trust) ensures that new-entrants, and smaller players would rapidly be able to capitalize on performance and social status. The reputation engine is one of the pillars of growth for platforms. And improving the trust in the system is the key action platforms can put in place to keep increasing the quality level of the exchanges in the ecosystem (as platforms can control the quality in a traditional way).

This Platform Play helps you answer the questions:

- How can we facilitate the best to emerge?

- What elements of reputation should we harvest in the subject value chain?

PP6. Aggregation of Demand (and supply)

By aggregating demand, platform strategies also overcome the traditional (push) “sales” perspective and move into “pull”. Network effects will indeed drive greater attraction to a growing context and it is therefore crucial to aggregate context demand stages so as to generate a pull effect on the supply, in turn generating more demand attraction. This mechanism is crucial to start first and then keep on feeding the Network Effect, that is how platforms grow. We will soon write a post on Network Effects, stay tuned!

This Platform Play helps you answer the questions:

- How can I control demand and aggregate it as an input channel for this strategy?

- What elements do I control in order to generate a demand aggregation?

By applying these Platform Plays together (or at least those that are more relevant and have the greatest impact on the current ecosystem), Platforms can re-shape the value streams and help leverage unexpressed potential.

Let’s see how the process works with a practical example.

Photo by Andreas Gücklhorn on Unsplash

An Example Context: Prosumer Renewable Energy

The context we have considered for this example is the Independent renewable energy production one, described as follows:

Thanks to the plummeting cost of solar technology, and the pressure for new local sources of energy, the market of investing for, and installing prosumer solar infrastructure and be connected with the energy trading network is ripe for growth. On the other hand this market is still very industrial and mostly in the hands of energy incumbents. What would it mean to draw a platform strategy to grow and empower the potential of distributed networks of expert advisors, technology installers and prosumers?

We’ve started with listing the experiences that the ecosystem is offering right now, and we mapped them into the Ecosystem Scan canvas.

We are mapping the experiences:

- Choosing the right producer of solar panels and finding the best installer;

- Finding a financing source for the installation;

- Perform the installation of the system;

- Connect the photovoltaic system to the power grid and comply with the regulations and norms.

As a general insight coming from this first step, we can see that the typical interaction is between the consumer, who wants to install a new PV system in her property (we can imagine because she wants to waive the cost of energy, or make some extra money as an investment) and a solution provider (essentially a company that can technically install a certain solution). The contact point is typically through a web search, sometimes through a “solution advisor” could be a professional working in that field (an engineer, an architect, a construction company). The web search is a moat (think Google), obviously. We have other moats in the financing and connection experiences, since banks, bodies in charge, and national power distribution grids are typically “established and entitled by law”.

Note that solution providers are hiding, in the line of sight of the value seen by the consumer, many kinds of suppliers: the solution advisors and the manufacturers or de-specialized workforces. This is contributing to an inefficient distribution of opportunities and keeps the entry barriers to these investments high, causing a loss of opportunities to the entire system.

Value Chain mapping

As we were expecting, being this context a pure industrial one, the shape of its value chain is a “C”.

In this value chain map, prosumers (they are consumers, that then become producers after they start selling electrical power to the grid) are rather commoditized since their special needs are never taken into account: every consumer looks the same, to the providers. The solution provider acts as a broker, hiding many professionals who can emerge and have more standing to the consumers. In addition, this context is really fragmented and poorly scalable, since the greatest part of the business process is custom-built and not automatized.

Here comes the new part we have been describing above. We need to bring prosumers and solution advisors at the top of the value chain and in direct relationship so that they can engage in niche relationships such as geographic ones (mountain vs seaside), type of building (commercial vs residential, etc…) and more. Everything in the business process that can be automatized and released as a SaaS needs to be changed in that direction. This will help entities and roles to work collaboratively on the best tailor-made solution to satisfy consumer needs. Think for instance to curated lists of solutions helping to orient both sides to the right offer, assess the needs and the expectations, and a system that can simplify the request for financing and document approval.

The reputation engine will help the best solution advisors and providers emerge from the crowd, guaranteeing at the same time an overall flawless quality of the installations.

As you can see, the strategic shift towards platforms can be visually appreciated in the Z-shaped value chain. Note that a new role is emerging (i.e. acquiring more importance, visibility and “dignity”): the solution advisor, who has the expertise to guide the consumer through the best solution for her case.

The Platform in this context should aim to put the three roles — consumer, solution advisor, and solution provider — in the high personalization of solutions area and, more interesting, offer to manage the integration between the technical solution and the bureaucracy needed to comply with regulations from institutions and get funding.

Design Phase

The Opportunity Exploration phase is giving us a finer granularity to capture the emerging value from the ecosystem and is helping to take into account the complexity of the interactions already happening among entities and roles.

This deep understanding of the context is precious to give a more solid strategic grounding to the Platform Design phase, that we are approaching in this section. Please remember that all the details on how to execute a complete platform design process can be found in our Platform Design Toolkit User Guide, inside the toolkit download pack available here.

First thing to do in this case is to get to map the entities-roles in the Ecosystem Canvas: having completed the transformed Wardley Map we can pick from there. As a quick reflection: we are here considering a simple case for educational purposes, but more scenarios could be considered such as energy trading or in the development of local micro-grids. On this map, please note that solar panel manufacturers are seen as stakeholders, since their products are nowadays pure commodities and the value of this ecosystem is accrued elsewhere.

If we look at the portrait of the solution provider, we see the typical footprint of a producer of value or a partner, willing to improve her revenues through reaching more customers, improving her branding and positioning, optimize the daily routines. The prosumer is highly motivated not only by economical returns but also by a green spirit, even if she is currently blocked by the high entry barrier to having a renewable energy plant at home due to bureaucracy, hard-to-be-esteemed costs, uncertainty and lack of trust on the vendors and suppliers side.

The Motivation Matrix helps us visualizing value flows in the ecosystem and gives a quick overview of the most interesting relationships among entities or roles. In this example, we can highlight that a very interesting interaction is that between consumers and solution advisors. These professionals are those who are really experts on the specific technology and are those who really advise the bests technical and economical solution for the final users. Sometimes providers have an interest in playing the advisor role to the users, but making the two roles clearer can provide a more transparent solution design process, and more competition on efficiency between providers.

Exploring transactions helps us unbundle the interactions currently happening in the ecosystem. This is important to establish how and where entities are in contact and how the platform, through its strategy, can reduce the transaction costs and enable more niches by lowering down the barriers to niche sustainability.

In particular, between solution providers and advisors, a new channel can be established, enabling ratings and feedback exchange. This is a direct advantage for the consumers, who can finally choose the best suppliers for their needs and select the offering based on their special needs. Of course, on the other hand this would let the best producers to emerge, contributing to the improvement of the quality of the services exchanged.

The Learning Engine Canvas is the internal growth engine of all platforms and really makes the difference when entities choose to play through the platform itself, instead of staying outside.

Consumers want to find the best technical and economical solution for their needs, and here they have lists and catalogs that help them find the right supplier and the viable financing method, to have the best power system installed. They will later get better by exploiting the power generation at its best (i.e. maybe by adding components or insurances) and explore new opportunities by stepping into energy trading, or local grids (i.e. selling the electricity in the neighborhood, increasing the energy resiliency of communities) or simply by referring other consumers as potential customers for the supply side.

Solution advisors and providers need tools to make their daily routines optimized and reduce costs. An interesting evolution for providers could be to increase their scope and robustness by partnering with different professionals: an automated supply chain produced by the platorm owner could help providers focus on the technological advancements, and reduce cost due to mass buying.

Advisors on their hand could start thinking to get larger contracts by collaborating with general-purpose installers, for instance, or directly with manufacturers.

All the design bricks (i.e. the transaction engine and the learning engine) are summarized into the Platform Experience Canvas.

Even by considering the simplest experience offered by this context, i.e. the installation of a new solar system, we see that if we (i.e. the platform) can keep the experience as simple as possible, every entity or role will benefit from this. By reducing the paperwork, and the friction generated by the lack of clarity on expectations and offerings, we step into a win-win game. The overall installations turnover is increased, consumers are happier since they could evaluate serenely an investment opportunity and hopefully stay in the approved budget, solution suppliers (advisors and providers) can emerge according to their professionality and quality.

In this example, we have a clear transactional business model, since the platform can charge users with a fee per transaction and, for this reason, it’s offering free learning (i.e. free information and guidance) to all the interested parties. This opportunity to learn and improve is a strong attraction point towards the ecosystem and that is why it’s important not to hide it behind a monetary request. On the other hand, it’s possible to imagine different sustainability models: for instance, if the platform strategy focuses on producers, maybe they will appreciate membership-based access to free networking and partnering opportunities, or to curated catalogs of solutions.