Diagnosing a Product Portfolio with Brian Balfour’s Four Fits – and the Portfolio Map Canvas

Discover how to evaluate complex product portfolios using Brian Balfour’s Four Fits framework integrated with the Portfolio Map Canvas. Perfect for startups, scale-ups, and enterprise organizations managing diverse product ecosystems, this approach provides a visual diagnostic framework to identify revenue vulnerabilities, optimize acquisition costs, and assign clear organizational accountability. With real-world examples and practical metrics, learn how to navigate the transition from single-product to portfolio strategies in today’s capital-selective environment.

Simone Cicero

When we released the Portfolio Map Canvas a few months ago – and during the preceding two years – we envisioned it as a visual tool to help organizations connect customer needs, market offerings, and organizational capabilities. We aimed to help organization and product leaders design product and organizational development strategies aligned with customer needs and market dynamics: to build organizations and strategies in an “outside-in” perspective relevant for customers.

The teams we’ve been working with initially used it primarily to visualize their sprawling product and platform ecosystems. After dozens of client sessions, the map has evolved, and in a recent engagement with one of our customers, we explored using the canvas with Brian Balfour’s Four Fits framework to diagnose the health of various product systems.

This conversation led to an exciting use case of the Portfolio Map, combining its visualization capabilities with an interesting diagnostic approach. In this framework, the map becomes a dashboard—a place where teams can quickly identify revenue vulnerabilities and out-of-control acquisition costs and pinpoint exactly which organizational unit owns the responsibility for improvement.

[A Special thanks goes to Prashanth A and all the team from Bosch Mobility Platforms and Solutions for suggesting an encouraging the use of Balfour Four Fits as a Diagnostic Approach in combination with the Portfolio Map Canvas.]

The Growing Challenge of Portfolio Health Checks

In today’s environment, the simplistic “do we have Product-Market Fit?” is an insufficient question for maturing businesses. As organizations grow in size and product offerings, they often manage multiple core products, numerous add-ons, and various regional bundles.

In a recent conversation with NfX’s Pete Flint, he succinctly recapped:

“What you want to optimize [in a product environment] is LTV (lifetime value). The key drivers are churn and willingness to spend on a monthly basis. The best companies have this profile of net revenue retention and growing LTV, becoming highly valuable businesses.

The third trend is the rapidly decreasing cost to deploy software. […] The ability to add incremental products and services to your platform is much easier than it used to be. There was a point of view in Silicon Valley, 15-20 years ago, that you should be a single-product company, but that’s not true anymore.

You should start with a singular breakthrough product experience to get product-market fit, but once you’ve achieved that, you can start to expand. This is the concept of “stackable” business models.”

At this point, the concept of “fit” fragments. Which product are we evaluating? Through which channel? Supported by whose cost structure?

In the meantime, we’ve also switched from an era of easy money (ZIRP) where fundraising was easy with minimal Product-Market fit and traction, to an era where products must demonstrate business sustainability. Technology and AI now provide significant leverage (three-person unicorn?) and greater independence from capital. Investors are tightening requirements: they ask for investees to offer preferential protections to investors, and the possibility of asymmetric outcomes and hard-to-commoditize moats. All this was greatly highlighted in Sam Lessin’s State of VC in 2025 report.

The transition to this model (portfolio, higher marginality) requires startups, scaleups, and corporate venture builders to deal with:

- Their product system is becoming more complex: it’s essential to consider hierarchies between products (product systems, bundles, lead products, and add-ins).

- Digital capabilities, AI, and underlying IP, technology, or infrastructure moats are increasingly overlapping and integrating.

Consequently, the inherent underlying organizational complexity needed to perform against this backdrop requires greater organizational awareness: as products multiply and share enabling layers or innovative technologies, teams and their relationships must be framed more complexly.

For corporate innovators, where product and service differences are often greater than for startups or scaleups, the ability to distribute strategic business outcomes is even more important.

Similar dynamics are emerging in private equity and venture capital: investors’ greater specialization in vertical fields and niches means they become more aggressive in requiring and defining certain operating models and seeking synergies between portfolio components.

Brian Balfour’s Four Fits: More Relevant Than Ever

Amid growing complexity, we’ve thus rediscovered a remarkably enduring framework. Brian Balfour’s Four Fits framework—a counterintuitive voice in the zero-interest-rate era—has become critical in today’s capital-selective environment.

This heightened focus on product model sustainability is precisely what Balfour’s Four Fits evaluate:

- Market ↔ Product Fit: Does anyone desperately need what you’ve built?

- Product ↔ Channel Fit: Can you reach them efficiently? Recoup your customer acquisition cost quickly enough?

- Channel ↔ Model Fit: Do the unit economics add up? Will customers deliver long-term value?

- Model ↔ Market Fit: Can the product/service model help us achieve our company objectives?

Take a moment to evaluate this opportunity: if you’re dealing with a portfolio strategy and want to optimize your organizational arrangements and product offering, ensuring you deliver value for your customers….join us in Madrid in June!

The Multi-Product Portfolio Challenge

Traditional playbooks for evaluating these fits assume a one-product, one-channel model. However, portfolio companies operate in a more complex reality. In our experience with customers, we’ve established a common base product-service taxonomy, mirroring the platform organization topology we propose with the 3EO.

When developing a portfolio, one must recognize and define:

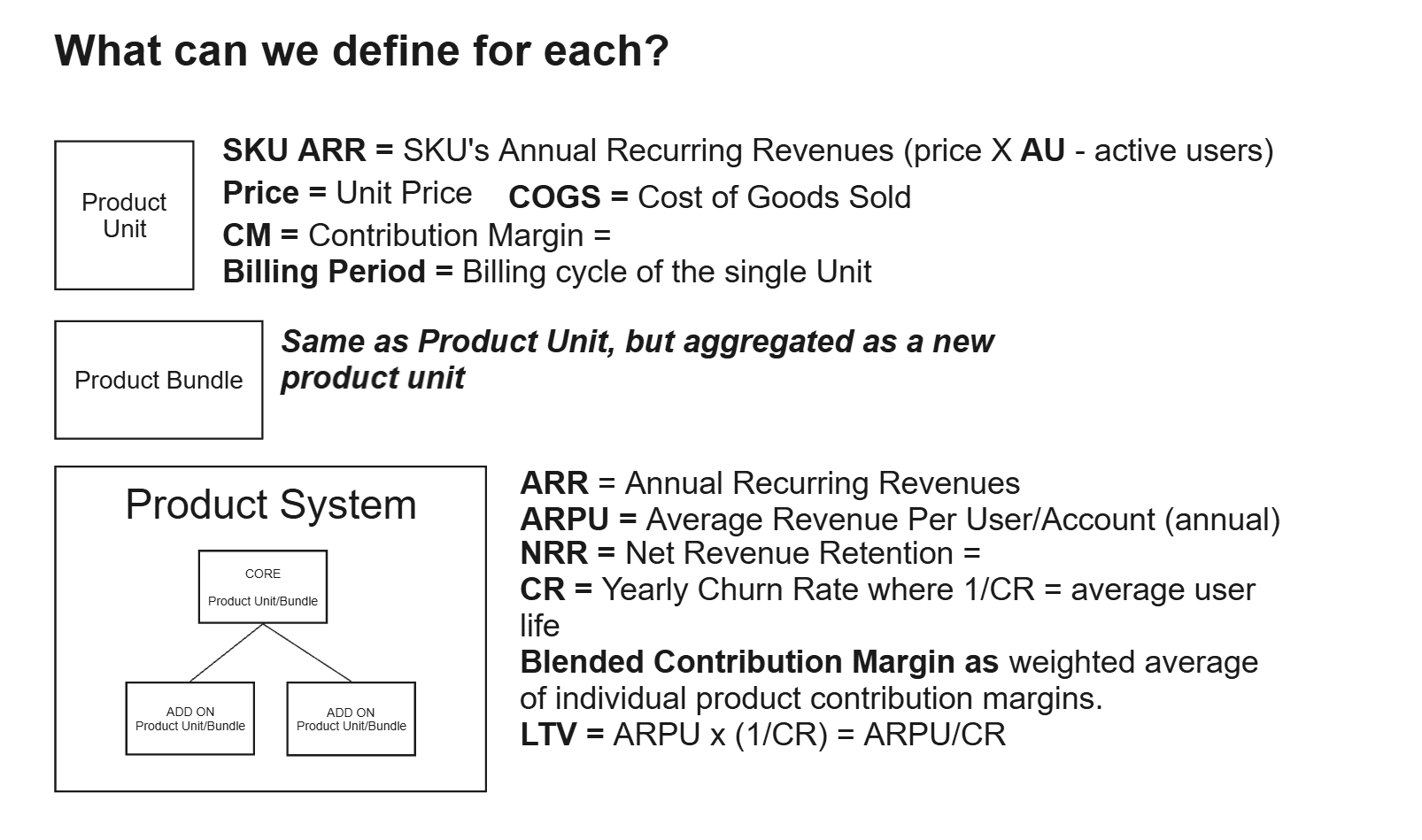

- A Product Unit with a unique identifier is a component with its own price, COGS, and contribution margin. This can also be a bundle of two or more existing Product Units. For the sake of clarity, a bundle is identified with a dedicated identifier. An example of a product unit could be access to a SaaS product (a unit), and a bundle could be access to a set of plug-ins.

- Product Systems are coherent clusters containing multiple product units. For simplicity, a Product System has a core product plus add-ons. For example, think of access to SaaS as a core product and a cloud backup service as an Add-in. The core product is needed to activate other product units as add-ins.

- Diverse GTM Engines: As mapped with the Portfolio Map canvas, one company could have field sales in specific regions, a product-led growth funnel, and distribute its product globally on hyperscaler marketplaces. All these Channels help go-to-market for one product system. We typically consider the Channels for a product system as we assume customer activation happens once per product System with the core product’s activation.

- Overlapping Teams: Product areas, regional sales squads, shared growth resources, and cross-functional communities.

In this environment, channel-related metrics like Customer Acquisition Cost (CAC) and Payback Period are tied to the product system and activation channels. Net Revenue Retention (NRR) is also tied to the product system as it depends on customers activating add-ins and increasing ARPU.

Our Two-Layer Data Model for Portfolio Diagnosis

To address this complexity, we’ve created a two-layer data model that separates metrics by their appropriate level:

Product Unit/Bundle Layer Metrics:

- Price, COGS (Cost of Goods Sold), and Contribution Margin %

- Billing cycle

- Active logos/users

- Unit-specific ARR

Product System Layer Metrics:

- Current ARR and ARR goal

- ARPU

- NRR

- CR (Churn Rate)

- Lifetime Value = ARPU x 1/CR)

- Blended Contribution Margin

- CAC & Payback Period per channel

- TAM and target market share

This structure enables complete rollups: contribution margins flow bottom-up for payback calculations, while ARPU and NRR flow top-down for lifetime value.

Applying the Four Fits Across Your Portfolio Map

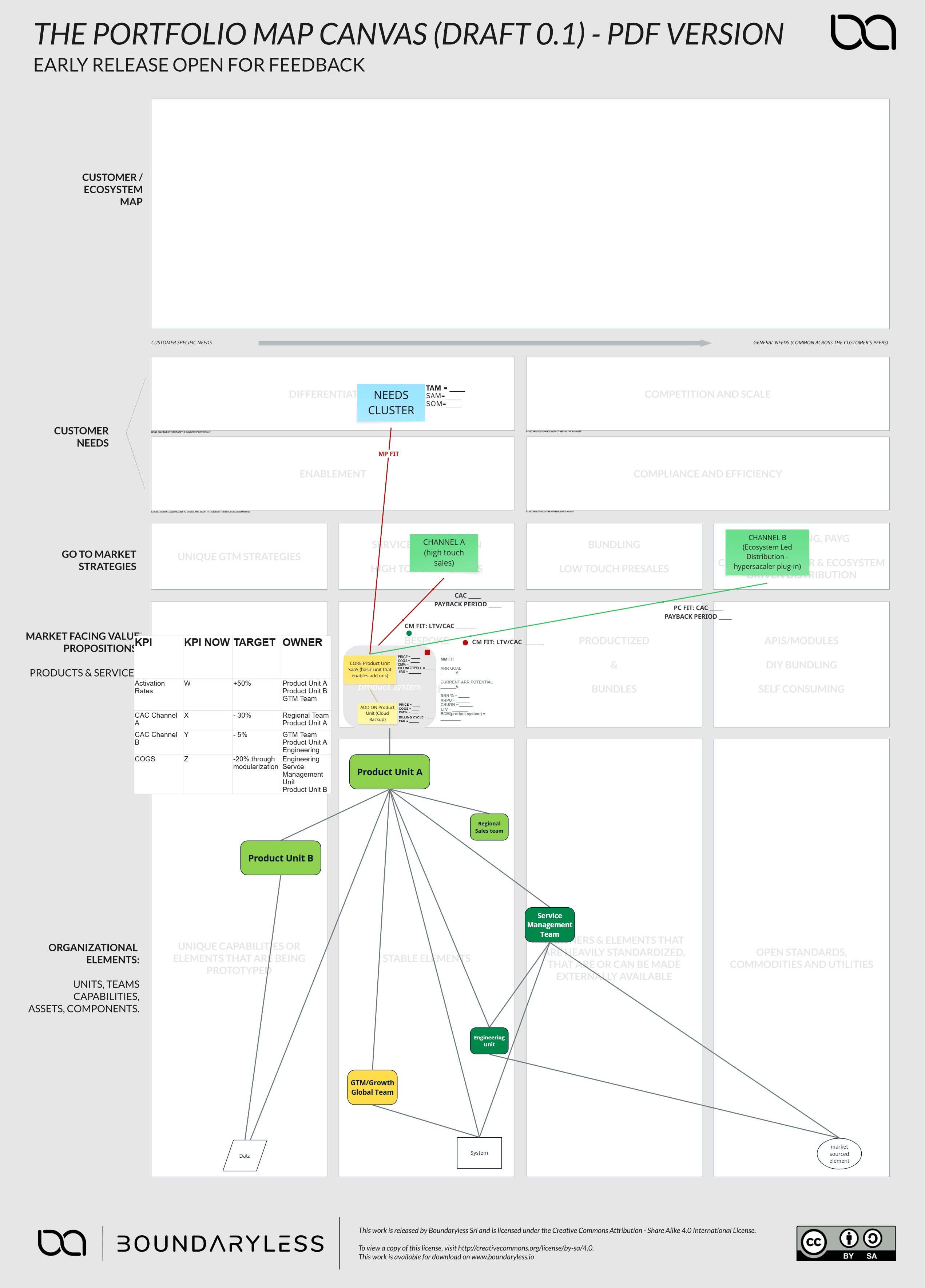

Integrating Balfour’s Four Fits with the Portfolio Map Canvas provides a visual framework for assessing the four fits for each product system.

Let’s first examine a typical product system representation on the map. The Needs cluster (represented as a single post-it for simplicity) is connected to the core product unit. In turn, the core product unit and the underlying product system are associated with the current GTM channels to reach and activate customers.

The product system has a typical organizational arrangement with:

- A product unit (A) that leads the product roadmap;

- A product unit (B) supporting unit A in product delivery could be an emerging AI team helping Product team A deliver productivity improvements in the form of Service-as-Software.

- A regional sales team collaborating with the Product A unit to sell the product to the enterprise through Key accounts (Channel A, High Touch);

- An Engineering unit that develops the underlying differentiating technologies and interacts with the product units as covered in a previous post.

- A service management team that runs operational efficiency, a first-level service desk, and relies on Engineering for 2nd and 3rd level support.

- A global GTM/Growth team that runs the marketing motion and supports the Ecosystem-Led motion to distribute products through hyperscalers as a “plug-in.”

- Internal unique company data

- A set of internal systems (F&A, CRM…)

- Externally sourced components, like off-the-shelf software

In this setup, one can use the map to visually frame a diagnosis through the four fits.

Market ↔ Product Fit: We can use the map to represent, the connection quality between the needs cluster and the Product System by changing the link’s color. If the system has low activation rates or low ARPU, the connecting arrow can turn yellow or red.

Product ↔ Channel Fit: Visualized on each channel arrow, judged by payback period. Green indicates payback ≤12 months, yellow for 13-18 months, and red for >18 months.

Channel ↔ Model Fit: Represented on each channel arrow’s base as a semaphore badge. An LTV/CAC ratio ≥3:1 is healthy (green), 2-2.9:1 merits caution (yellow), and <2:1 signals trouble (red).

Model ↔ Market Fit: Compares your strategic ARR goal with ARR potential (ARPU × TAM × target share %). A colored square on the top right of the product system box indicates if the required strategic scale is achievable.

After diagnosis, one can quickly draft a table like the left one, identifying key leading indicators and assigning ownership—ideally collaboratively—for moving them in the right direction, hoping the change will deliver the required business outcomes.

In the discussed example:

- Improving Activation rates would be the responsibility of the Product Units and GTM team, as they depend on the quality of Marketing Qualified Leads and product onboarding.

- A reduction of CAC for Channel A would be the responsibility of the Regional Sales team and Product units, as they depend on the quality of Regional leads and the success of small-scale POCs and Demos.

- Reducing CAC for Channel B would be the responsibility of the Global GTM team, Core Product Unit, and Engineering teams, as it depends on distributing well-made plug-ins on the hyperscalers’ marketplace.

- A reduction in COGS would put it in charge of the Engineering and Service Management Team and Product Unit B, which delivers GenAI-powered Customer Support.

Multiple-product systems sharing enabling capabilities push organizations toward platform-based operating models with shared service platforms, micro-enterprises, and ecosystem contracts. The Portfolio Map makes these relationships visually explicit.

Clear accountability structures are essential for startups managing their capital relationship and corporate innovators distributing strategic business outcomes effectively.

This framework is powerful in two organizational contexts:

In platform-based operating models (like 3EO) where units self-manage their P&L, teams can create explicit agreements (EMC contracts) around improving specific metrics. These contracts can include mechanisms for sharing benefits when indicators improve – for example, the AI team could share in the cost savings from automation reducing customer support costs.

In traditional organizational structures with centralized P&L ownership, the framework helps leaders cascade objectives more effectively. It provides visibility into which teams must collaborate to move specific metrics, making it easier to set meaningful OKRs and assign accountabilities across the organization.

Real-World Scenarios

This integrated approach delivers immediate insights across organizational contexts. Let’s explore a couple of examples from real-world experiences:

- In a Scale-up context, a SaaS company considered adding a Premium Supply Chain Intelligence offering to its invoicing platform. While unit economics looked promising, the Model Market Fit didn’t turn green after calculations—even optimistic projections couldn’t meet their €20M targets due to an intrinsic limitation in the pool of interested customers. They redirected investment toward increasing ARPU by adding a payments module to their core offering, turning the dot green.

- In the Enterprise Organizations context, a multinational packaging solutions company faced big red Channel-Model badges. Customer acquisition through distributors in Brazil had a long payback period and uncertain lifetime value due to market unpredictability, now incresing with tariff uncertainty. By shifting to embedded partnerships within a factory automation provider, they reduced payback periods to a few months and managed Lifetime value uncertainty.

What’s Next

We’re extending our Growth Model spreadsheet and canvas to handle multi-product simulation, allowing metrics from the Portfolio Map to flow into cohort projections.

Meanwhile, you can diagnose most portfolio challenges visually: coloring the four key connections and strategic scale indicator makes weak spots immediately apparent.

The Bottom Line

Balfour’s Four Fits haven’t just survived—they’ve become more relevant in our post-ZIRP, capital-selective era. Integrating them with the Portfolio Map Canvas creates a powerful diagnostic instrument. It gives startups a clearer capital strategy, helps scale-ups prioritize product investments, and shows corporate teams where accountability must be strengthened.

Most importantly, it reminds everyone that growth isn’t wishful thinking—it’s a chain of fits that you either align successfully with or don’t. In today’s challenging business climate, this clarity isn’t just helpful—it’s essential.