The 4 Key Problems that hinder growth in Platforms and Marketplaces

Ever more often than not, we’re asked to help founders and designers address lagging growth issues. This is because – differently from what happened in the first years of activity of Boundaryless – many more adopters (and customers) have now performed the first steps of drafting a platform strategy, prototyping it, getting some validation from the market and are now encountering their hurdles with product traction, validation, and growth.

Simone Cicero

Luca Ruggeri

Manfredi Sassoli de Bianchi

In this post we want to offer an overview of what are the main issues that often affect teams and products seeking growth and how a VP of growth, head of growth, CMO, founder of designer should think of addressing these.

We’ll also offer pointers in our recently released Platform Growth and Product guide, so you can locate some knowledge and tools you can rely on.

What are the main issues that hinder growth?

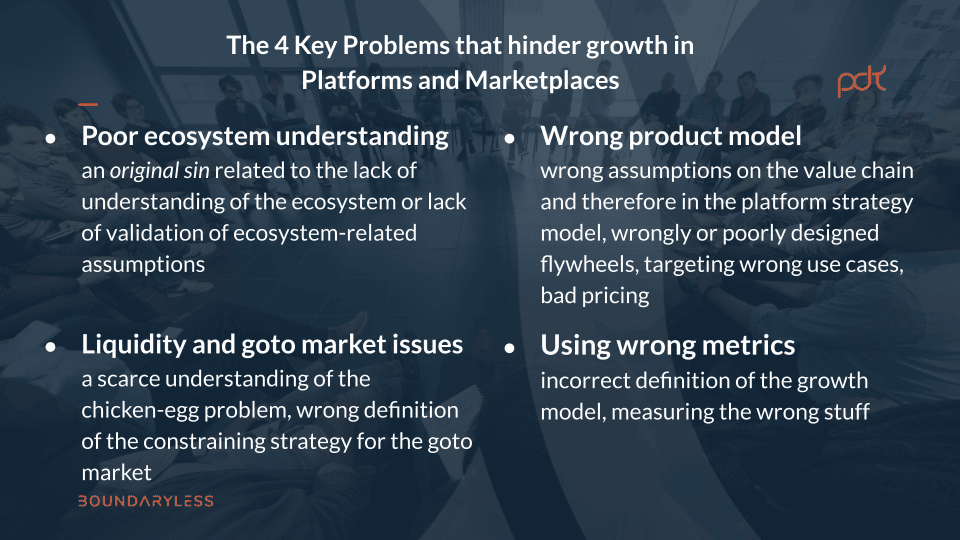

In our experience, there are four main issues that affect platform growth that we can recap as follows:

- Poor ecosystem understanding: an original sin related to the lack of understanding of the ecosystem or lack of validation of ecosystem-related assumptions;

- Wrong product model: wrong assumptions on the value chain and therefore in the platform strategy model, wrongly or poorly designed flywheels, targeting wrong use cases, bad pricing;

- Liquidity and goto market issues: a scarce understanding of the chicken-egg problem, wrong definition of the constraining strategy for the goto market;

- Using wrong metrics: incorrect definition of the growth model, measuring the wrong stuff;

Let’s look into them in details.

On July the 27th we’re going to run a FREE Ask Me Anything session on our newly released Platform Growth and Product Guide, don’t miss the opportunity ti mingle with the co-authors of the Guide and ask for guidance on how to rely on the new set of tools we released, integrating them in your processes for product development and growth:

RSVP for this session as it’s going to be accessible only to subscribed participants: SUBSCRIBE HERE

Your platform is not growing because you originally didn’t understand your ecosystem

As our loyal readers and adopters will know, at Boundaryless we are big proponents of adopting an outside-in perspective to building platform strategies, but what do we mean by that? In a few words we always point out that platform strategies should always start from mapping the ecosystem interactions, the players, the mediators, the resources being used, and we do it with our Arena Scanning and Ecosystem Scanning techniques. One of the first things you should be doing in case your growth is lagging is to come back to your arena and ecosystem scans (or the equivalent you’re using) and ensure the information you have collected about the domain is reflecting real behaviors. If you perform the ecosystem description by leveraging second hand knowledge, it may be worth it for you to touch base with domain experts and use them as sounding boards for your maps. Interview campaigns can also help, especially as you move into identifying jobs to be done and expected outcomes that will build up part of your go-to-market strategy (“am I building a platform for ‘overserved’ or ‘underserved’ customers?”).

Why is it important to have the ecosystem dictate the strategy you can pursue? For a clear reason: paid growth in a world where advertising has become extremely competitive will cost you a fortune, while resonance-based growth – that is premised on you fully understanding the ecosystem expectations, jobs to be done and expected outcomes – will be essential to achieve pull-based, organic growth. This is why we always use the information that we map from the ecosystem to develop the product strategy, and this connects nicely with the following point.

Check these two blogs and our Opportunity Exploration tools to understand more:

- Defining the Ecosystem Domain: Ecosystems, Arenas and Jobs-to-be-done

- Adopt Outcome Driven Innovation and the Jobs to be Done framework within Platform

Your platform product model is wrong

Once you’ve a (hopefully reliable) understanding of your ecosystem, your job is to articulate a platform strategy that resonates with that: your mission is essentially to create something that the ecosystem is “looking for”.

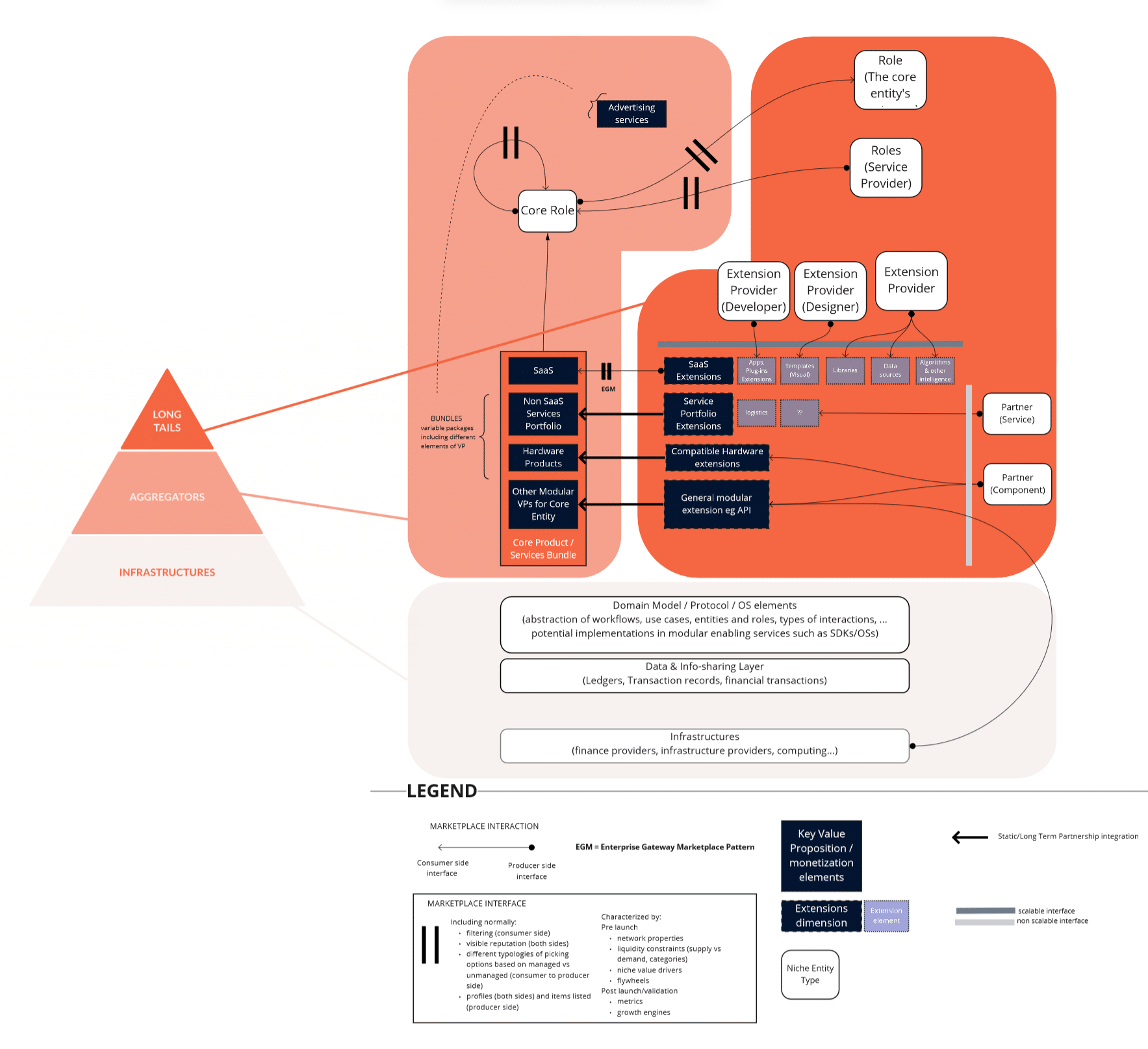

As our readers may recall, a platform strategy model is a mix of three main value proposition elements:

- a product/service bundle that is normally targeted to “producers” in the ecosystem (we often call it the core customer);

- a marketplace that connects your core customer with their demand or suppliers;

- an extension platform element, i.e. a way for you to engage with partners and third parties creating clear ways for them to develop components that can extend the features of the product/service bundle, either as apps or plugins or with user generated content.

Point number 3 above normally comes fairly late in the development process, as to be really attractive to third parties to develop extensions you normally have to have an already healthy platform that reaches lots of customers, but a good point to raise in relationship to lagging growth is that you could prioritize some extensions and work to integrate them punctually at the very first stage by directly engaging with certain partners in non-scalable ways. By developing such nurtured and curated partnerships and collaborations to bring particular key extensions to your customers from day 1 you may bring more attractiveness to your product.

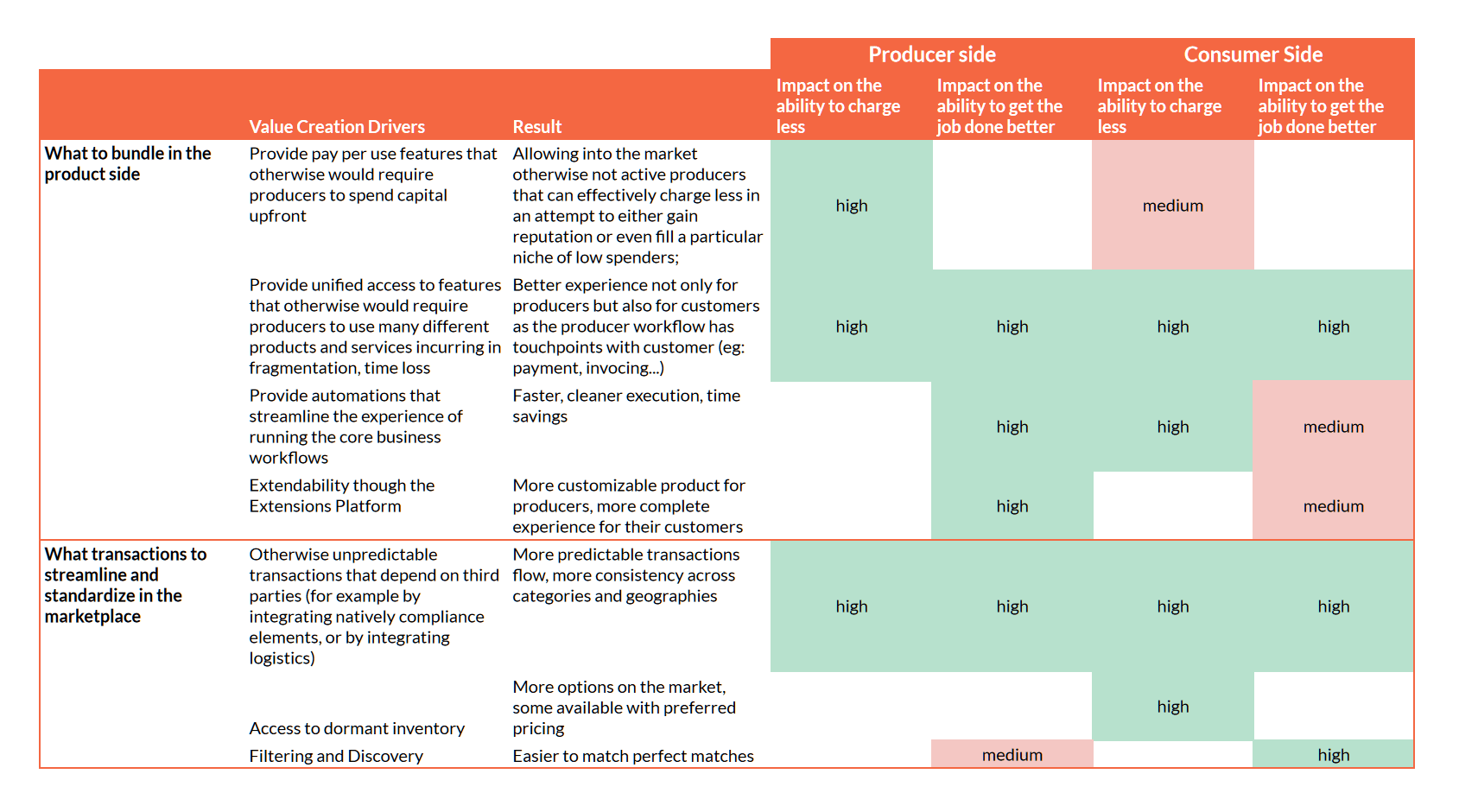

To understand what needs to go into the product features breakdown we follow a process that consist in abstracting value chains and interacting with them visually: we recently discussed our approach in the piece “Apply Value Chain Analysis with Wardley Maps to identify a Platform Opportunity” which we definitely suggest you to read – especially if you’re using the Platform Design Toolkit methodology – but we can share some basic heuristics here. We also had the chance to think about how platform strategy models overall can provide a way to provide the market with options that are able to either “charge less” or “get the job done better”, for the sake of simplicity we provide a recap table giving you some hints about the questions you should ask, these apply to essentially any platform strategy:

- Is your product bundle answering to the key value creation drivers?

- Are your customers (on both sides) looking for being “charged less” or “doing the job better” and is your product delivering the corresponding features?

- Are you communicating them clearly to your customers?

Another key element you may want to consider in analyzing if your platform strategy model has issues – may be related to your flywheels. As you develop your platform strategy model, it is important that you picture out how value is supposed to accrue and how your flywheels are supposed to start spinning.

Most often, at the core of a platform flywheel there is a basic two-sided network effect, and other compound effects that build upon it creating:

- defensibilities, which are important to reduce churn;

- lock-ins that can reduce the market space for competitors, thus impacting both churn and user acquisition (as competitors will have hard times penetrating the market)

To approach designing the flywheel of your platform strategy, you can use the flywheel sketching canvas and our flywheels cards presented in page 48 of our Platform Growth and Product guide

Two further elements related to the product model need to be tackled when growth is lagging: one is pricing, and the other one is ensuring you’re targeting the right use cases.

Pricing can be very problematic and hinder your growth very badly. Foremost you need to understand that pricing needs to be used strategically and – in some phases of the development of your platform strategy – you may need to use more aggressive pricing schemas, especially towards one of the sides of your marketplace, to ensure user acquisition is not slowed down by friction (see page 40 of our Platform Growth and Product guide, “How to use pricing Strategically in Platforms and Marketplaces”)

Over the longer term, pricing needs to be addressed with a deep understanding of what the “value metric” of the user is: you need to ensure that customers are paying for what they want to consume and that the process of purchasing is well framed in the customer context (essentially being both feasible and manageable). Let’s say that for example you adopt a “pay per seat” strategy in a business context where the customer is not the buyer: this may entail high process hurdles for the user as she has to go back to purchasing for acceptance. Our Platform Growth and Product guide has an entire section on pricing (page 32+) that we really suggest you to grapple with.

Another issue you may have, that is hindering your growth, may be related to the particular use cases you’re targeting: always try to assess if the use cases the platform covers are the most frequent and valuable for the users, if not, possibly pivot.

You may be having marketplace liquidity issues that prevent your growth

Another recurring problem teams tend to have as they pursue growth is related to liquidity. This is most probably the most obvious reason and the most well known: especially when it comes to two-sided marketplaces (a strong and important component of a platform strategy) liquidity is to attain patiently and the chicken-egg problem is one of the most draining issues teams may be dealing with.

Foremost, especially if you’re at a very early stage of development, you may have to consider “constraining” your market to kick-start the liquidity that would be otherwise very hard to kick-start in a larger, unconstrained market context. Typical approaches to constraining marketplaces have historically been around geographies (start from a single city – à la Airbnb) or categories (start from books – à la Amazon). More specifically, in our recently released Platform Growth and Product guide we introduced (or, better, we aim at popularizing a concept previously introduced by Dan Hockenmeier) the idea of a canonical unit. Understanding your canonical unit, essentially the way the different “dimensions” or “categories” in your market collide, is essential to understand what customers are looking for and may give you a way to set up your constraining strategy. Normally, the canonical unit has a geographical element – especially for services that depend on two players meeting physically – and multiple categorization layers.

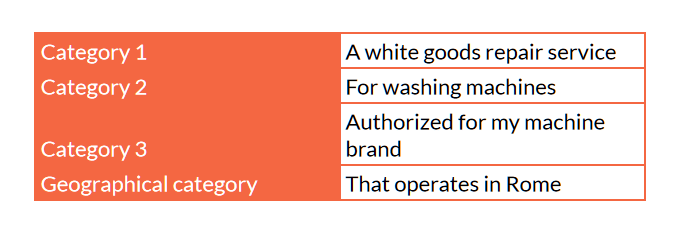

One can think for example of someone looking for:

such a canonical unit characterization may lend itself for you to kick-start liquidity starting from constraining one or even two of the above, deciding for example to start building liquidity not for a worldwide marketplace for white goods repair services, but instead for washing machines repair services in Rome (and later expand into other cities and/or machines)

Further problems that may impact your capability to kick-start liquidity may be related to you focusing on the wrong side of the marketplace. Despite this is a fairly contextual question that is hard to answer “algorithmically” you may want to focus on three things for both sides:

- understand if you’re not growing because there’s a trust issue on any of the sides that impedes some participant to transact on the platform for “risk-related issues”;

- understand if there’s an investment needed to onboard (especially on the providers side) that they are hesitant to make;

- more generally understand if there’s a terrific change in habits vs the usual behaviors that entails more investments on onboarding on your side to generate more liquidity.

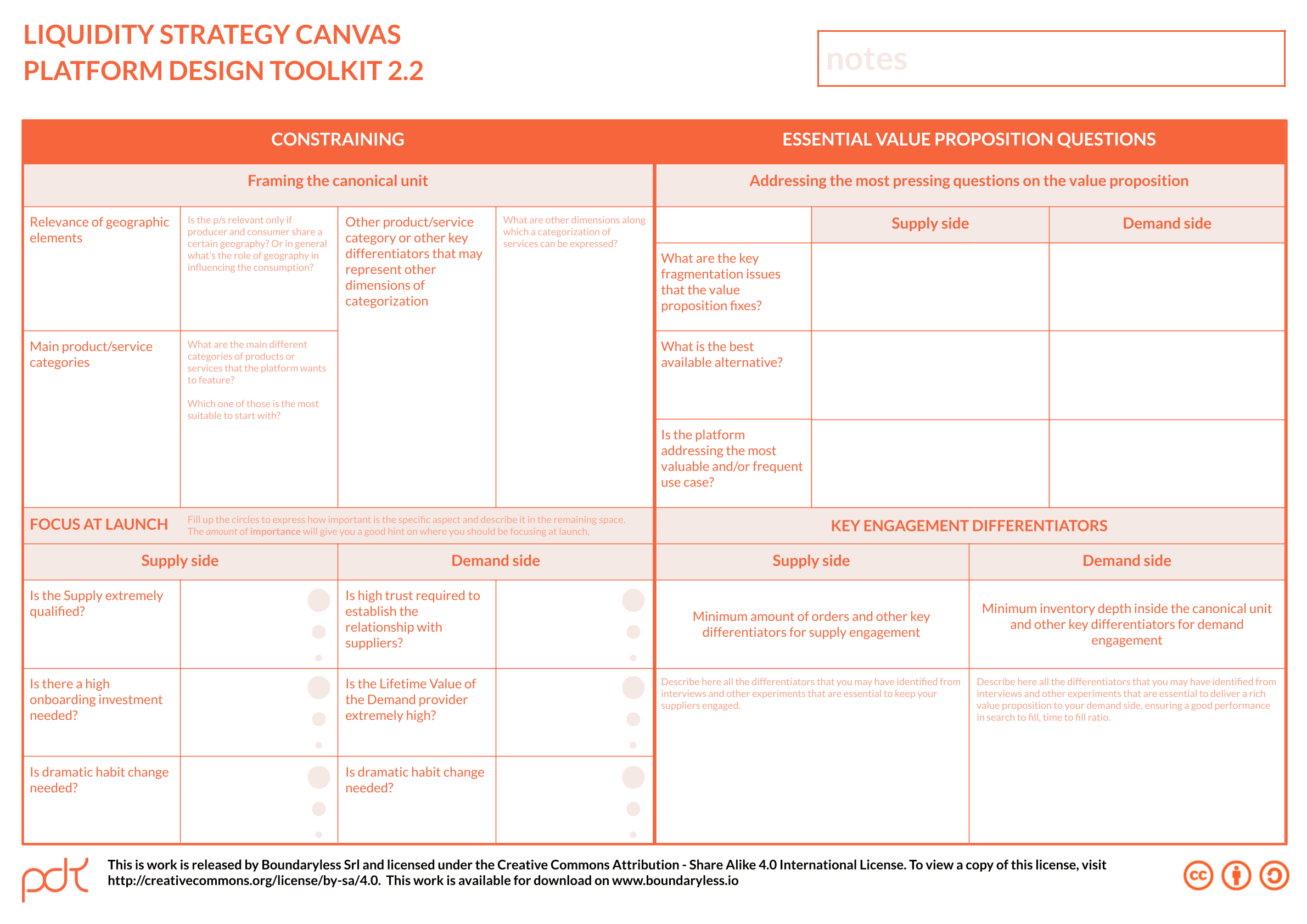

There’s of course an entire world of further “tactics” that you should know – and you may not be using thus incurring on lagging liquidity and growth – that we suggest, starting from creating single user value / single player mode features on the platform, but the best would be for you to check:

- the Liquidity Strategy Canvas – presented in our Platform Growth and Product Guide at page 82

- our Growth Tactics framework – presented in our Platform Growth and Product Guide at page 57+ in conjunction with network properties (the characteristics of the network underlying your marketplace)

You may be using the wrong metrics

Finally, it’s important to understand that to really assess growth you need to focus on measuring the right information: the result of measuring the wrong metrics could be the either you optimize your investment for the wrong stuff, or, more luckily, you may be not measuring growth and progress that is – in reality – happening.

In the Platform Growth and Product guide we present the idea of a growth model and we provide a breakdown of metrics based on measuring liquidity/engagement, retention and economics metrics.

The essential work for you here will be that of:

- identifying your target metrics (output metrics),

- understand how target metrics are related to more easily impactable metrics (input metrics);

- create a growth model that allows you to measure and predict how investing in certain activities or processes will impact any new cohort of users from the perspective of producing an impact on our overall metrics (especially on the input ones)

Conclusions

In this quick blog post we presented four key elements that you have to consider when dealing with a platform with lagging growth.

All of these elements are covered in our recently released Platform Growth and Product guide: check it out and start iterating!

Simone Cicero

Luca Ruggeri