Navigate 2024: Marketplace and Platform Trends Reshaping B2B

Secure success in B2B with our reflection examining 2024’s platform and marketplace trends. Grasping ‘platform-ecosystem’ thinking to market solutions, understanding fintech and AI integration, and being cognizant of niche-targeting verticalization hold precedence more now than any time before. We bring you detailed analyses of two key industry reports, taking you behind the scenes of this digital revolution and helping you evaluate the impact in terms of organizational development.

Simone Cicero

Unpacking the Transformation in B2B Platforms: your Guide to 2024

In the last few weeks, two major reports have been released that an audience attentive to the evolution of markets and products in the rapidly changing digital landscape has to keep an eye on: the State of Platforms 2024 Report and Dealroom’s and Adevinta’s State of Online Marketplaces in 2023.

In this article, we identify common trends that these reports collectively point out. We use them to better understand how things are shaping up on the market and what the organizational and product implications are for companies, especially those operating in the B2B service space.

The B2B space is undergoing radical changes: trends that make technology development and adoption easier, and addressing vertical niche markets is becoming more sustainable. A generational change towards digitalization, driven by millennials now taking hold of family businesses and gaining management positions, is in place.

But how is technology altering the course of the market? And how are millennials stepping into positions of power influencing this change? Let’s explore.

The key trends

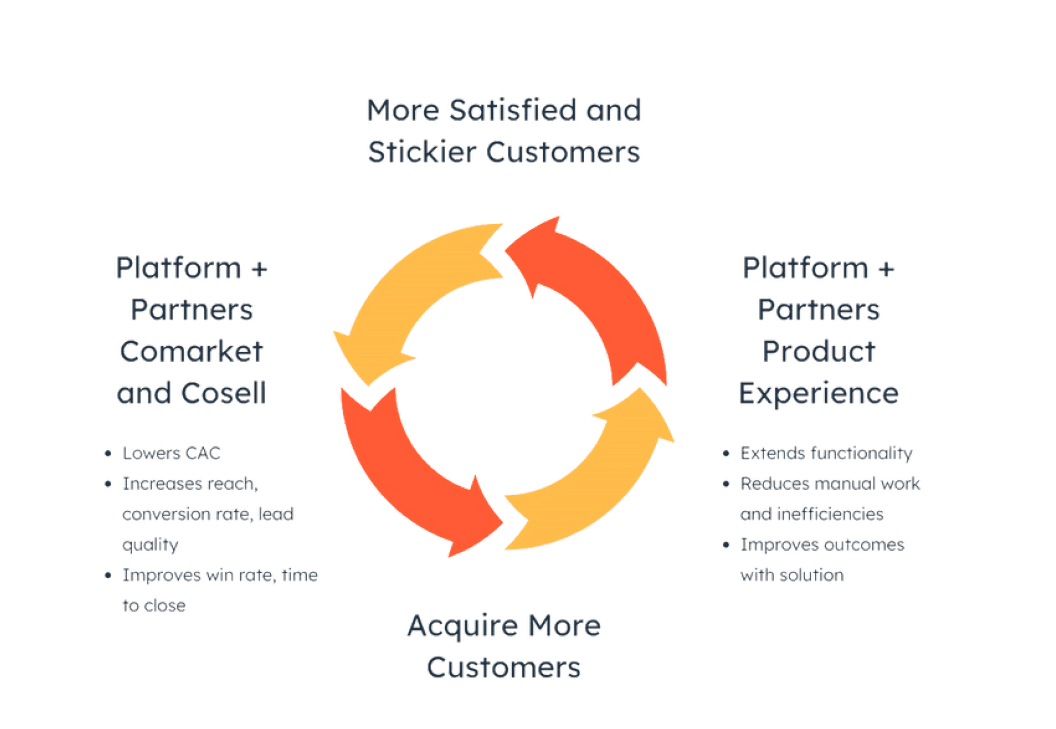

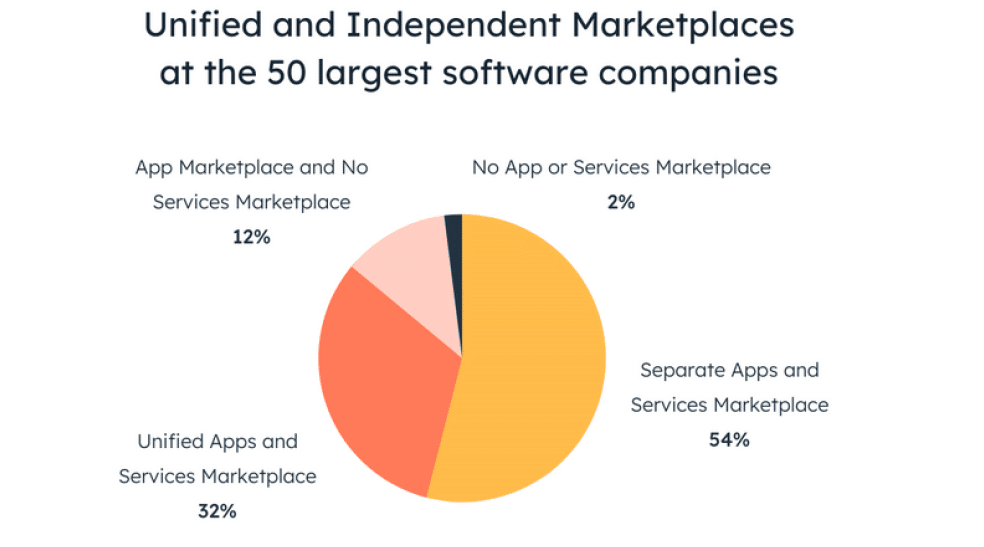

The first trend is a clear rise in the adoption of Platform-Ecosystems tactics for organizations as a way to market their solutions. Platform-ecosystems strategies are becoming central to B2B software companies as they provide a relevant differentiation mechanism and a way to create hard-to-commoditize market advantages, while also representing a positive flywheel for third parties (platform partners) that can generally acquire customers at a lower cost. This implies a growing role that partnership management has in business both from the platform and the partner perspective.

Increasingly, leveraging networks of partners and services to drive innovation and economic value is a pivotal capability in organizations doing B2B. This capability becomes essential because there are some corners in the market with niche-sized customers, coexisting solutions, or limited budgets, where high marketing and high customer acquisition costs or long pre-sales processes are unsustainable.

As the industry allows for smaller players to enter the market, these small players often prefer a software-centered, DIY, and streamlined process for the adoption of new productivity solutions calling for offerings that are modular and self-serving, powered by horizontal platforms that reduce the cost of running a successful business.

The major consequence for organizations is the need to step up their partnership development capability and learn how to facilitate the birth of ecosystems of third parties that can extend their products and help distribute them more widely. This can be done by repackaging, complementing, and extending them.

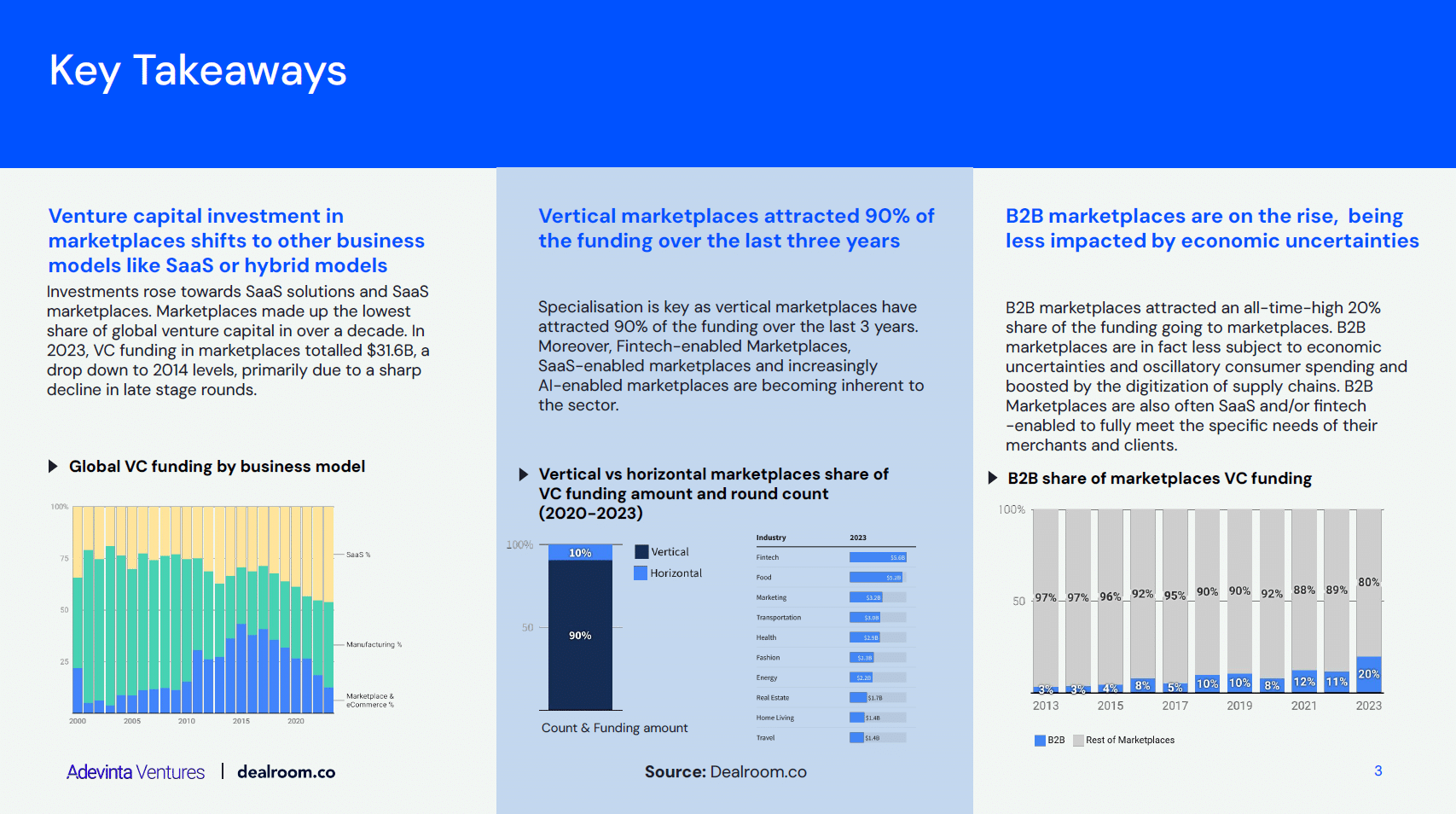

Verticalization and Nichification: Specialization in Vertical Marketplaces

Another trend that emerges from both reports is that of vertical marketplaces and platforms. Those vertical solutions are attracting a significant portion of funding, indicating a move towards specialization and industry-specific solutions.

The clear evolution of markets towards more niche reflects a broader democratization of the market. This trend will continue with the adoption of AI as part of software development. AI will automate and generally lower the cost needed to develop niche solutions. Smaller markets will thus become more profitable and sustainable.

Furthermore, the increasing capability to mold ancillary services with technological, software-based solutions makes niche marketplaces more sustainable.

In this process, we should keep in mind the so-called “unbundling fallacy”. Dan Hockenmaier explains in his seminal essay that it’s easy to assume that going niche allows you to develop a more relevant offer for the market.

On the other hand, these solutions need to ensure long-term sustainability. Achieving strong differentiations versus mature horizontal platforms does not ensure that you can achieve a good payback period if, for example, going niche thwarts too much of the number of transactions that such marketplace platforms can facilitate at scale.

The Emergence of B2B Marketplaces

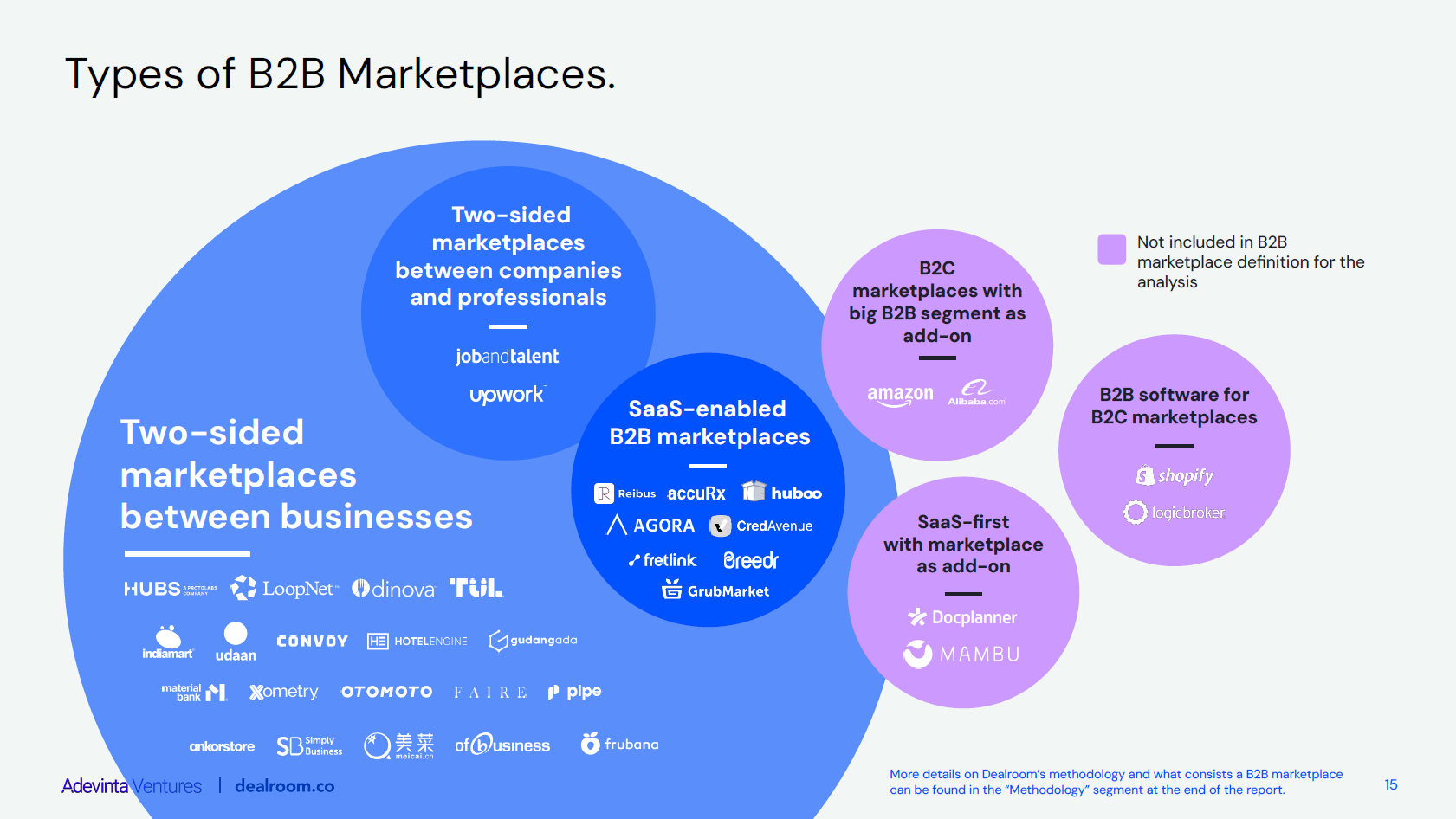

In any case, the reports paint a clear trend with B2B marketplaces gaining momentum. This is driven by digital transformation and the need for efficient and more integrated supply chain solutions, to transform the “back-end” of the market.

Companies are increasingly developing complex products in this transition. These products do not just provide ERP-like solutions that help make processes or data management digital but also provide so-called “hybrid” solutions where Software (commonly provided as a Service) combines with marketplace features.

Hybrid solutions are penetrating markets traditionally based on long-term supplier-provider relationships, high investments, hard-to-change agreements, and cumbersome procurement processes, transforming them into easier relationship management, more competitive bidding systems, and generally less brittle and less complicated contract management solutions.

Common patterns in this sense are the following:

- supplier marketplaces – helping the customer find pre-screened suppliers more easily through a software-powered network;

- demand marketplaces – helping the customer market its services to new customers and/or managing transactions more easily through the platform with existing customers;

- Consultants often help adopters of a specific mission-critical software solution find the right people to help them implement, tune, and evolve a particular software adoption in marketplaces.

Integration of Fintech and AI in Marketplaces

Another key trend that these two reports point out is Fintech and AI integrations. Such extensions of the value provided by a particular software solution powering business processes are becoming increasingly common in SaaS and marketplaces. They enhance user experiences by reducing friction and increasing operational efficiency.

If it’s true that AI is now going through its peak of inflated expectations, we need to acknowledge that it can already provide sensible productivity and security gains by providing, among others (if you are interested in more details, we wrote about AI and Platforms):

- AI-based support to empower suppliers to produce more;

- AI-based search and AI-powered advertising;

- Better fraud detection;

- Customer service.

On the other hand, fintech solutions provide modular finance elements such as quicker capital allocation and on-the-spot credit powered by credit score checks, trade finance capabilities, smartly metered insurance, and more. This becomes useful in reducing transaction costs and facilitating the growth of well-performing actors as we move into B2B verticals, to their benefit but also the overall health of the platform-powered ecosystem and the platform’s owner.

The embedding of AI and Fintech solutions also gives software (platform/marketplace) vendors their chance at acquiring certain “control points”. As Tidemark explains in the Vertical Software Knowledge Projects, vertical SaaS platforms are increasingly generating significant improvements in other areas that can make them hard to displace, on top of the classical control points of workflow, data, and account ownership (owning the relationship with the main sponsor of adoption).

Decreasing software development and provisioning costs enable the adoption of usage-based pricing models. Additionally, integration with third-party software and marketplace creation improves customer experience, providing real value to customers and locking their processes in.

What does it mean for your organization?

If you’re operating in the B2B space, this transition means a lot for your organization both from an organizational architecture perspective and a strategic (product line) perspective.

These two layers (the organizational structure and product portfolio) are converging in a way. Since you can no longer only build one product strategy, you’ll need to develop a portfolio of strategies and therefore your organizational structure needs to map and provide the relevant capabilities.

This shift to portfolio thinking is largely because options and opportunities are increasingly niche and small. Therefore, organizations will have to develop multiple value propositions to remain relevant.

Furthermore, you will need to empower several active teams to build multiple, sequential, and compounding value propositions that combine, even inside a specific vertical opportunity space. For example, if you’re building vertical ERP software, chances are your second product could be a service marketplace built on top of it.

Such a second team will:

- require the development of a new set of dedicated capabilities organized around a different team shape and leverage shared internal platform services (see how we explain this in our “Adopting a Product-Centric Operating Model at Scale”)

- contribute to a shared and coherent Go-To-Market motion that will ensure the collective success of all its offering components (check out our recent: Responding to Multiple Customer Needs with Products and Services).

The second point is going to be crucial, particularly for organizations that are used to getting to the market with a pure and traditional sales-led approach.

The empowerment of multiple teams relies on your organization’s work to define how a Multi-Product Portfolios can be built, how Bundles get created inside the organization and ultimately how customers can use a DIY process to tune your product offering to their own needs.

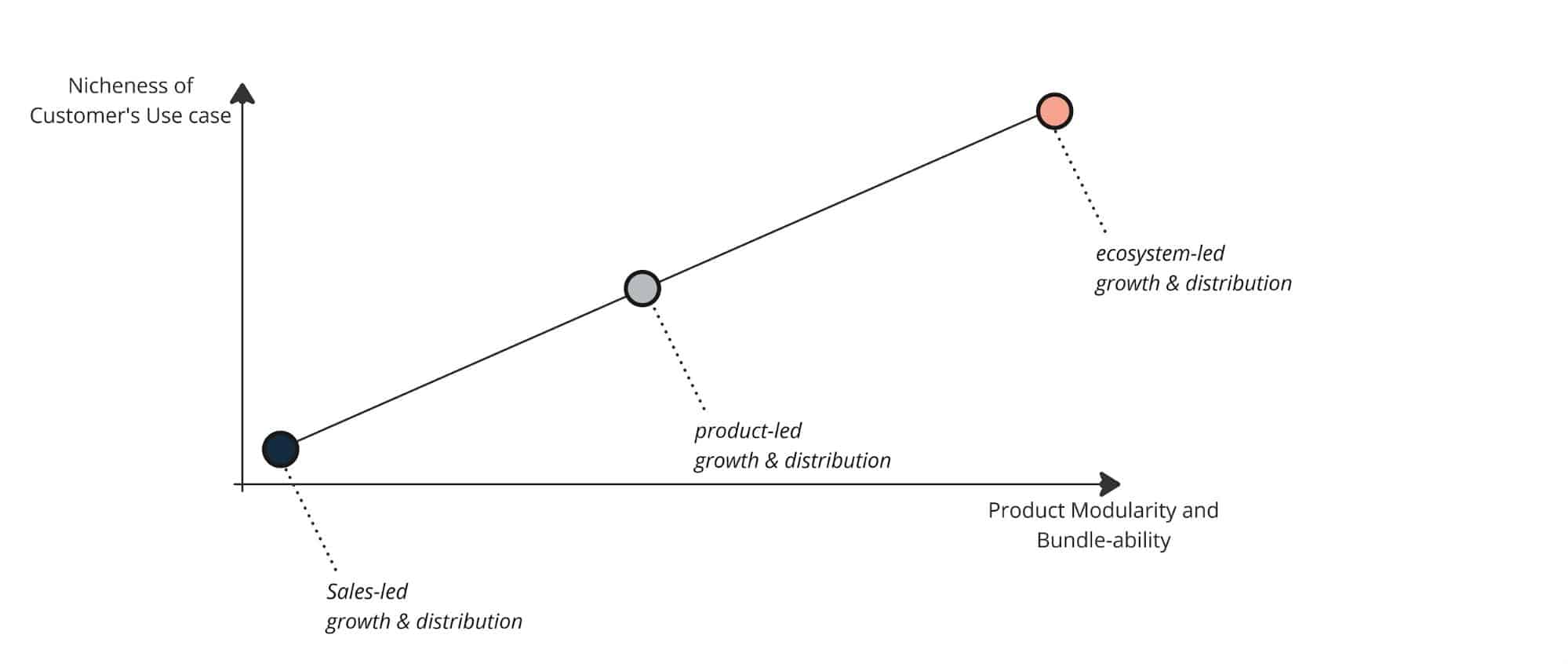

As organizations and markets digitize, products and services will have to be placed on a spectrum. This spectrum ranges from those that you can position on the market through intense sales/pre-sales-led processes to those that will require a product-led market motion and others that will require an “ecosystem-led” market motion. In the ecosystem-led market motion, your components will be remixed and marketed inside other products catering to use cases that you’re not able to formalize internally, and your distribution partners will figure it out for you.

Conclusions

We are finally at a moment in time when organizations of all kinds, and especially those that are active in the B2B space, cannot avoid measuring themselves with the challenges that a market dominated by low transaction cost patterns such as platforms and marketplaces asks them to face.

The main challenges involve adopting diversified and distributed organizational models where units require autonomy and economic accountability and go-to-market is strategically framed. Market-facing units will have to develop literacy for the adoption of platform and marketplace models. This can be either as weavers of the partnership ecosystem around their leading products or at least to understand the dynamics and economics of distributing their own products and services across third-party ecosystems.

This adaptation process will pose massive challenges to the typical control and management structures of B2B service companies. It will simultaneously represent extremely interesting avenues of growth, especially as such design and go-to-market patterns (SaaS, Marketplaces, Extensions, and Apps ecosystems, APIs,…) will be increasingly sustainable in small and niche markets and thus viable for most organizations and not just Silicon Valley giants.